Understanding Credit Scores

What is a credit score?

A credit score is a number that represents the risk a lender takes when you borrow money. Your credit score shows how likely you are to pay back money you borrow.

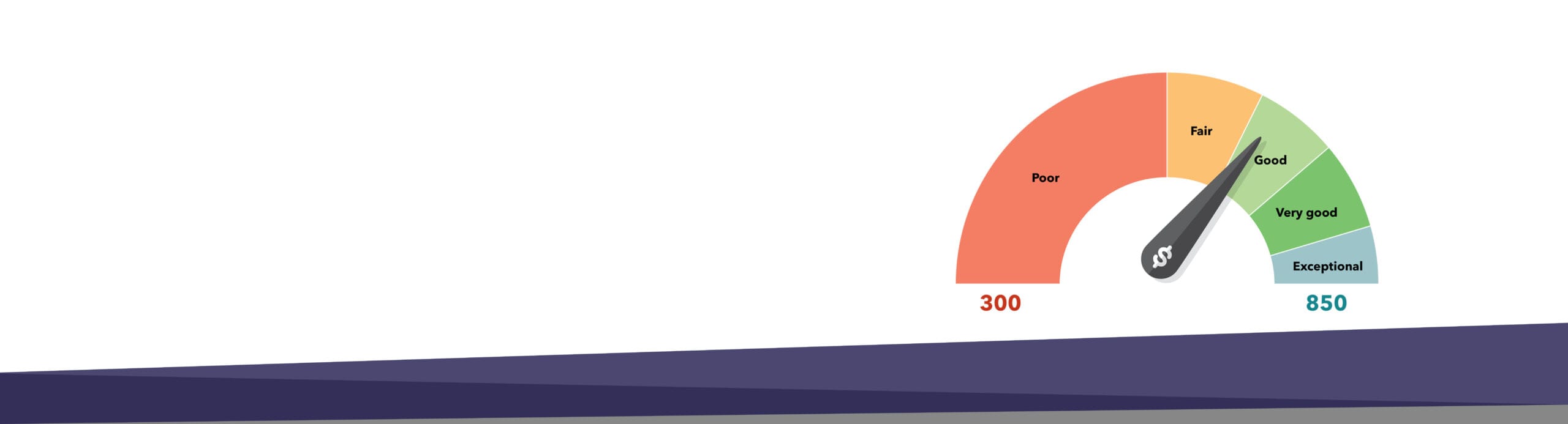

Most credit scores range from 300 to 850.

A higher credit score means you are predicted to be less of a risk. Usually a high credit score makes it easier to qualify for a loan and may result in a better interest rate.

Your credit history and behaviors form the basis of your credit score.

The way you use and repay debt affects your credit score. Paying loans on time and staying well below your credit limit helps you get and keep good credit. Here are the things that go into determining a person’s credit score.

- Payment history: Whether you are paying bills on time and as agreed. This accounts for 35% of your FICO score.

- Total debt: The total debt you owe and the remaining credit you have available. This accounts for 30% of your FICO score.

- Length of credit history: How long you’ve had an account or loan. This accounts for 15% of your FICO score.

- New or recent credit: All new loans or accounts and all creditor credit report requests. This accounts for 10% of you FICO score.

- Types of credit: All credit cards and loans. This accounts for 10% of your FICO score.

Information provided by the Consumer Financial Protection Bureau